Technology has simplified almost every aspect of our lives, and the financial sector is no exception. Portfolio building is a complex task of investing in a wide range of shares and ensuring risk minimization while maximizing potential returns. The only way to simplify this process is to use some kind of technology, including Excel and dedicated platforms. In this guide, we are going to discuss how the technology when employed correctly can amplify your ability to build well-diversified portfolios and monitor risks effectively.

Stock Portfolios Explained

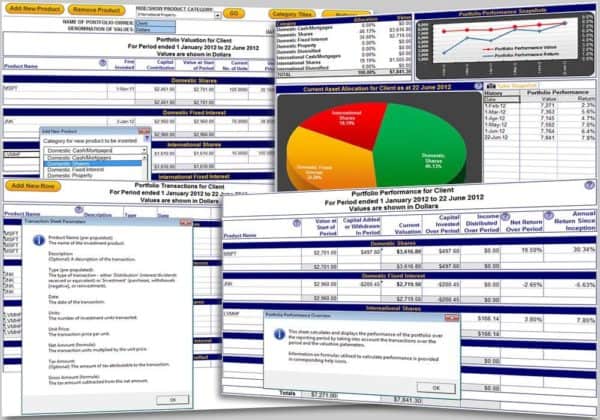

A stock portfolio refers to a collection of stocks that an individual or institution owns in diverse stocks, representing a portion of their investment assets. Depending on the investor’s or trader’s financial goals, the composition of the stock portfolio can vary. Risk tolerance and investment horizon also play an important role. To successfully manage stock portfolios, traders, and investors must select a diverse range of stocks to minimize risk while aiming to maximize returns. Composing a powerful portfolio requires not only knowledge and experience but also advanced technologies, as the process requires continuous monitoring and analysis to make informed decisions about managing stocks. Traders and investors should make decisions to adjust their portfolios by buying, holding, or selling stocks based on market conditions, economic indicators, and individual company performance. The most basic and well-known technological means to create a stock portfolio and monitor its performance is to use Excel, but it requires certain skills and specific knowledge to do so successfully. A guide on how to create a stock portfolio in Excel will provide you with all the steps necessary.

Also Read – All The Tech You Need To Trade Stocks At Home

Traditional Methods of Portfolio Monitoring

Before modern computers and smartphones, monitoring a stock portfolio involved the manual process of reviewing printed financial statements, tracking stock prices in newspapers, and even consulting with financial advisors and brokers. Investors had to rely on periodic reports and face-to-face meetings to get updates on their portfolio’s performance and make decisions accordingly. Needless to say, this process was slow, costly, and time-consuming. This approach required significant time and effort, with information often outdated by the time it was received, leading naturally to less responsive decisions in fast-moving markets. Some traders would have to wait till the next day to visit their workplace and check stock prices and news. In the modern world, what it takes to monitor your portfolio is to look at the smartphone screen or computer and check for news every second. The capabilities are no longer limited and investors can react promptly and minimize risks greatly.

Key Technologies Simplifying Portfolio Monitoring

Modern financial technologies have dramatically simplified the portfolio monitoring and management process. Key technologies in stock portfolio management include:

Online brokerage platforms

Stock brokers provide their traders with advanced trading software. These platforms offer investors real-time access to their portfolio performance, market data, and research tools, allowing quick and informed decision-making. Traders and investors can just glance at the charts and other statistical data and manage portfolios accordingly. It takes a few clicks or taps to get all the real-time information about stock performance and important macroeconomic news to define if certain sectors of companies are less likely to perform well.

Mobile Apps

There are a plethora of investment apps allowing users to monitor their portfolios on the go in real-time, offering alerts on stock performance, and news updates. These apps also allow executing trades from anywhere. Popular trading platforms also come for smartphones. The apps like MT5 and TradingView allow traders to monitor a wide range of assets and their performance with advanced charting tools and built-in news features.

Automated trading systems

Automated systems execute trades automatically based on predetermined criteria, providing investors the ability to take advantage of market opportunities without constant monitoring. Some systems are technical and only take into account the price action, while others are more complex and allow new and fundamental analysis to be weighed in. AI-based portfolio management systems are the most advanced automated tools, allowing investors to hold portfolios without the need for human interventions. The vast majority of tools are paid ones and depending on their complexity the prices will be substantially costly. Free software like Excel allows traders to manually build and manage their portfolios for a fraction of the cost.

Data analytics and visualization tools

Advanced analytics software helps in analyzing large amounts of market data to identify trends, reversals, performance metrics, and potential investment opportunities. All information is presented on an intuitive dashboard with pie charts and other visualizations to simplify the process for investors.

Also read – Which Market Sectors Should You Invest In?

Enhancing Portfolio Performance with Advanced Technologies

Technology is also capable of enhancing portfolio performance through algorithmic trading, AI and machine learning, and robo-advisors.

Algorithmic trading

Algorithmic or algo trading employs complex algorithms to execute trading positions at the best possible prices, reducing the impact of market fluctuations and improving trade execution speed. Algorithms are very fast and efficient and make a trader’s job much easier.

Artificial intelligence and machine learning

AI and ML are trained to predict market trends and stock performance by analyzing vast amounts of data, helping investors make proactive investment decisions. Advanced AI algorithms can execute trades without human intervention and make trading much more efficient. However, AI algorithms are expensive and require substantial capital investment.

Robo-advisors

These automated platforms provide investors with personalized investment advice and portfolio management services at a lower cost than traditional financial services providers. Robo-advisors using algorithms to optimize investment strategies.

Challenges and Considerations

Despite being so effective, technology still presents certain challenges:

Security risks

When submitting sensitive private data to allow automated trading systems and algorithms to aid in trading and portfolio building, there are security risks to consider. Hackers are constantly evolving their software to steal important information, and any trader using modern technology must check their software for security. Using two-factor authentication, the security risks become much less of a threat.

Overreliance on technology

Despite being very helpful, too much reliance on technologies can end up in losses, as every investor needs to fully understand essential concepts of stock portfolio building and management. Technology sometimes may produce errors or incorrectly open positions and without extensive knowledge, investors might overlook significant information and lose money.

In the end, investors need both extensive knowledge and modern technology to keep up with modern financial markets and stay profitable.

Gearfuse Technology, Science, Culture & More

Gearfuse Technology, Science, Culture & More